No, 95% of Enterprise AI Didn’t “Fail” — It Wasn’t Set Up to Succeed

Hot take: The viral headline that “95% of AI initiatives failed” doesn’t mean AI is overhyped or broken. It means enterprises are still bad at selecting use cases, integrating tools into real work, and measuring impact. This post breaks down what the MIT report actually found, how it got misunderstood, and what the 5% who win are doing differently.

What the MIT study actually says

In August 2025, MIT Media Lab’s Project NANDA published The GenAI Divide: State of AI in Business 2025. The headline finding that made the rounds: ~95% of enterprise gen‑AI pilots showed no measurable P&L impact. That’s not “AI failed,” that’s “most pilots didn’t move the needle on financials (yet).”

What was measured: Not vibes or “cool demos,” but discernible impact on revenue/cost (P&L).

How they studied it: A mixed-methods look at the market, including hundreds of deployments and leadership/employee interviews and surveys.

What they concluded: Adoption is high, but conversion from pilot to production with business value is rare. The study calls this the GenAI Divide: lots of experimentation, little transformation.

Translation: most companies are still experimenting, not operationalizing.

Why this doesn’t spell doom for AI

- High adoption, uneven value — Other large-scale studies (BCG, MIT SMR/BCG) consistently show broad experimentation but concentrated value capture in a smaller subset of firms. That’s normal in early enterprise tech cycles.

- Wrong yardstick, wrong stage — A pilot often isn’t designed to hit P&L in quarter one. If you measure a science‑fair prototype against CFO metrics, you’ll log a “fail.”

- The issue is execution — The MIT report’s own narrative points to workflow integration, use‑case selection, and change management as the core blockers—not the quality of frontier models.

Bottom line: AI isn’t failing; enterprise adoption patterns are.

Where enterprises went wrong (patterns in the report)

- Use-case selection bias

Budgets skew to sales/marketing experiments because they’re visible, but operations and back‑office automation drive faster, cleaner ROI (contracting, intake/routing, reconciliation, content ops, risk reviews). - Build‑over‑buy reflex

Many large firms try to build bespoke systems first. The report and market coverage suggest specialized vendors/partners reach production more often than internal builds, especially for horizontal tasks (document automation, intake, support). - Pilot‑to‑production gap

Large enterprises run lots of pilots but take much longer to harden, integrate, and secure releases. Mid‑market orgs that limit scope and integrate quickly report ~90‑day time‑to‑scale; big companies often stretch to 9+ months. - Workflow, not just model

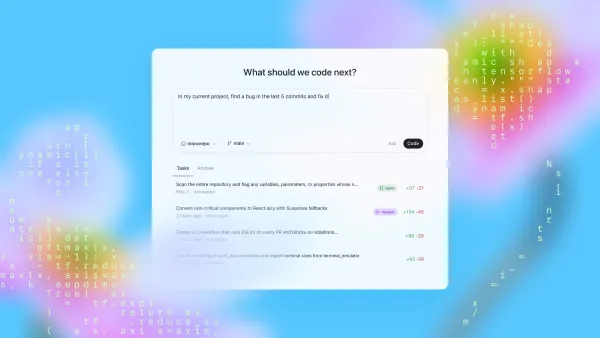

Demos focus on the model; value depends on connectors, policy, identity, approvals, guardrails, data lineage, and org change. Many pilots never cross this chasm. - Shadow AI vs. official AI

Employees adopt personal AI accounts faster than corporate tools. That highlights a governance/UX gap: official tools are slower, less flexible, and poorly embedded in daily systems. - Too many bets, too little depth

Leaders that concentrate on 3–4 high‑value use cases and redesign the workflow around them report far higher ROI than those trying to boil the ocean.

What the successful 5% did differently

- Picked workflow‑native problems with clear baselines (handle time, cycle time, error rate, backlog, throughput).

- Partnered where possible: buy/partner for speed on horizontal problems; build selectively for regulated or highly proprietary contexts.

- Instrumented outcomes up front with Finance: defined P&L levers and accepted evidence thresholds before shipping.

- Integrated deeply (SSO, DLP, data contracts, approvals) and invested in change management (training, role design, incentives, comms).

- Shipped fast, iterated weekly, and killed underperforming pilots quickly to reallocate budget to winners.

A practical playbook you can steal

1) Start in Ops & Finance

Target high‑volume, rules‑heavy flows with measurable toil: document routing, intake triage, contract variance checks, invoice exceptions, policy summaries, QA/QC sampling.

Define success before you start:

- Baseline (last 8–12 weeks): handle time, backlog, FTE hours, defect rate.

- Target: e.g., –30% handle time, –40% rework, +20% throughput.

- Evidence threshold: “We’ll call this a win if we hit ±X% for 3 consecutive weeks at N volume.”

2) Buy, build, or hybrid — decide with a rubric

- Buy when: use case is horizontal, time‑to‑value matters, vendor offers admin, analytics, and controls.

- Build when: regulated data, unusual workflows, or unique IP differentiation.

- Hybrid: vendor core + custom adapters (policies, prompts, evals, analytics).

3) Architect for production from day one

- Identity/SSO, RBAC, audit logs

- PII policy, DLP, redaction

- Data contracts, prompt versioning, eval harness

- Observability: success/fail reasons, tool latency, human‑in‑the‑loop metrics

4) Stage‑gate the portfolio (and be ruthless)

- Sandbox → Pilot → Limited Production → Scale

- Weekly adoption + outcome reviews with Finance and Ops.

- Kill or scale decisions every 2–3 weeks. No zombie pilots.

5) Train the work, not just the model

- Job aids, “golden path” SOPs, pair‑sessions, and feedback loops from users into prompts/tools.

- Reward measurable time saved and quality, not just usage.

So… is AI overhyped or dead? Neither.

The study is a reality check, not a eulogy. The technology is capable; enterprise muscle memory is the blocker. The firms creating outsized value are boring on purpose: fewer use cases, tighter integration, faster iteration, and ruthless measurement.

If you want to be in the 5%:

- Pick one high‑leverage workflow.

- Define hard metrics and evidence thresholds with Finance.

- Buy or partner for speed; build where it truly differentiates.

- Ship in weeks, integrate deeply, and measure relentlessly.

Sources & further reading

- MIT Media Lab / Project NANDA, The GenAI Divide: State of AI in Business 2025 (news coverage & mirrors).

- Fortune: MIT report overview & C‑suite implications (Aug 18 & 21, 2025).

- Tom’s Hardware: Summary of methods & “why” (Aug 2025).

- HBR: “Beware the AI Experimentation Trap” (Aug 2025).

- BCG: AI Adoption in 2024 — 74% struggle to scale value; Closing the AI Impact Gap (2025); AI at Work 2025.

(Tip: If you’re pitching this internally, anchor the conversation on P&L levers and a single, deeply‑integrated workflow. Then scale.)